Cash Flow Statement: How to Read and Understand It

By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via dividends or stock buybacks. When the cash flow from financing is a positive number, it means there is more money coming into the company than flowing out. When the number is negative, it may mean the company is paying off debt or making dividend business transaction definition and examples chron com payments and/or stock buybacks. However, that’s not always a bad thing, as it may indicate that a company is making investments in its future operations. Companies with high capital expenditures tend to be those that are growing. Ideally, a company’s cash from operating income should routinely exceed its net income, because a positive cash flow speaks to a company’s ability to remain solvent and grow its operations.

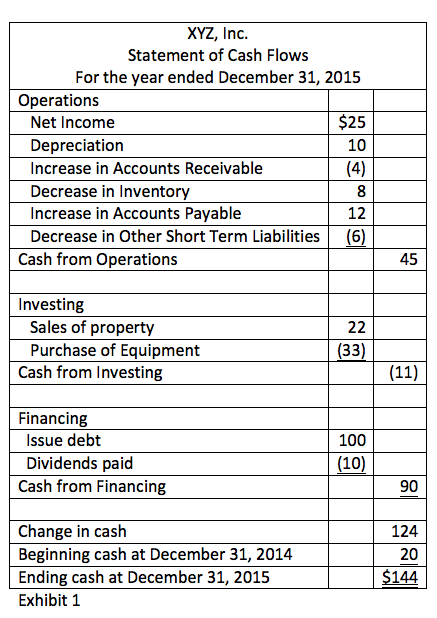

How Cash Flow Statements Work

See also the definitions of Adjusted EBITDA, Free Cash Flow, Adjusted EBITDA margin, and Net Debt under the Supplemental Disclosure Regarding Non-GAAP Financial Information section in this release. Cash provided by operating activities was $102.8 million, compared to $96.2 million in the prior year period primarily due to the increase in political revenues, largely offset by a decrease in broadcast revenue. Free Cash Flow was $73.3 million, compared to $67.7 million in the prior year period. The cash outflow for purchases of and capital improvements on property, plant and equipment (capital expenditures), software, and other intangible assets.

Cash Flow Statement (CFS) FAQs

To opt-in for investor email alerts, please enter your email address in the field and select at least one alert option. After submitting your request, you will receive an activation email to the requested email address. You must click the activation link in order to complete your subscription. Certain prior period amounts have been reclassified to conform to the 2024 presentation of financial information throughout the press release.

Statements of cash flow using the direct and indirect methods

Preparing for the CFA Exam requires a thorough understanding of “Analyzing Statements of Cash Flows II,” an advanced component of financial analysis. This section builds on cash flow classification, emphasizing deeper analysis of operating, investing, and financing activities. It highlights the implications of cash flow variations and their impact on financial stability and investment decisions.

- We made cash interest payments of $107.9 million in the three months ended September 30, 2024, compared to $108.7 million in the three months ended September 30, 2023.

- For an investment company or a trading portfolio, equity instruments or receipts for the sale of debt and loans are also included because it is counted as a business activity.

- Since these are liabilities, an increase would indicate that the liability was incurred but not as quickly paid out; thus it is an increase to the statement.

- Cash outflow in the form of capital distributions and dividends to common shareholders, preferred shareholders and noncontrolling interests.

- What makes a cash flow statement different from your balance sheet is that a balance sheet shows the assets and liabilities your business owns (assets) and owes (liabilities).

- In other words, it reflects how much cash is generated from a company’s products or services.

Digital Audio revenue increased $33.8 million, or 12.7%, driven primarily by continuing increases in demand for digital advertising. Audio & Media Services revenue increased $28.1 million, or 45.3%, primarily as a result of higher political revenue and an increase in digital revenue. Amount of income (expense) included in net income that results in no cash inflow (outflow), classified as other. The increase (decrease) during the reporting period in the aggregate amount of expenses incurred but not yet paid. Understanding how to create, interpret, and effectively use financial statements is pivotal for strategic decision-making. Financial statements, particularly, are essential tools that extend beyond simple record-keeping that can guide your business strategy.

What Is the Difference Between Direct and Indirect Cash Flow Statements?

If you’re a business owner or entrepreneur, it can help you understand business performance and adjust key initiatives or strategies. If you’re a manager, it can help you more effectively manage budgets, oversee your team, and develop closer relationships with leadership—ultimately allowing you to play a larger role within your organization. If we only looked at our net income, we might believe we had $60,000 cash on hand. In that case, we wouldn’t truly know what we had to work with—and we’d run the risk of overspending, budgeting incorrectly, or misrepresenting our liquidity to loan officers or business partners. Cash flow statements are also required by certain financial reporting standards.

Students should keep in mind that both interest and dividend incomes earned by an entity from investment in other entities are considered operating activities under GAAPs. However, IFRSs permit companies to treat these incomes as either operating or investing activities, depending on their accounting policies and procedures. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period.

In addition, we believe that Free Cash Flow helps improve investors’ ability to compare our liquidity with that of other companies. As of September 30, 2024, we had $431.8 million of cash on our balance sheet. For the nine months ended September 30, 2024, cash provided by operating activities was $70.2 million, cash provided by investing activities was $23.5 million and cash used for financing activities was $8.4 million. “Analyzing Statements of Cash Flows II” allows for a deep dive into liquidity metrics, which can reveal the company’s ability to meet short-term obligations. By assessing cash flows from operations, you can determine if the business generates enough cash to cover its day-to-day expenses without relying heavily on external financing.